With the New Year comes New Goals. Deciding what to focus on is not always easy choice. Health and Finances are normally the main areas one wants to improve including me. I’ve had the pleasure of meeting some of the coolest Smart Money Chicks over the years. I figured why not see what they would focus on. I asked each one of these Dynamic Women, What is one tip you would offer in 2016?

Let me just say now-WOW! They are really good. Take a look.

Focus On One Goal

Focus on one goal and focus on it hard! It’s noble to want to “be better with money” in 2016, but a non-

Focus on one goal and focus on it hard! It’s noble to want to “be better with money” in 2016, but a non-

specific goal like that can feel really uninspiring. Pick a specific goal, like paying off your student loans and focus on your “why” – why is your debt pay off goal important? What kind of freedom, flexibility and power will this give me in my life? This focus will help you stay motivated and focused while making better decisions on your day to day money. – Stephanie Halligan of The Empowered Dollar

Get Yourself a Coach

Every business owner needs a coach or mentor. The opportunity to tap into the knowledge, experience and connections of an expert is worth every penny. – Tiffany the Budgetnista

Consider Earning More Money

Consider Earning More Money

Focus on ways to increase your income this year. Reducing your spending and saving money are both really important, but earning more money is the most powerful way to change your financial situation. If you’re interested in earning money on the side via a part-time gig or side business, consider freelancing, consulting, or creating products based on what you already know how to do and people are willing to pay you for. – Kali Hawlk with XY Planning Network

Stop Mindless Spending

Figure out what matters to you. Then, work to stop spending money on the things that a weren’t important to you. Too often, we spend money without thinking about whether or not we care about what we’re buying. Decide what matters to you, and what you want to accomplish, and focus your financial resources in that direction. – Miranda Marquit of Planting Money Seeds and One of My Favorite New Podcasts Adulting

Pay Yourself a Wage

Pay Yourself a Wage

If you work for yourself or have a business, make sure that you pay yourself a wage. It can be as little $25 per week. I started doing this when I began my business in 2010, and over time, I have been able to increase the wage that I pay myself, which is a visual incentive to work hard and keep striving for excellence. It also represents an investment that I am making in myself. – Danyelle Little of The Cubicle Chick

Plan for your day.

Plan for your day.

Take 15 mins the night before to pack a lunch, set the coffee pot and lay out your clothes! You can spend some of that hard earned savings on something you really want, like a night out or vacation! – Athena Lent of Money Smart Latina

Stay on Top of Your Financial Tasks

Commit to a weekly time to pay bills, go over spending and budgets, and file paperwork. It will help you keep on top of all your financial tasks and start your new year off right. – Kelly Whalen of The Centsible Life

What will keep you going when you want to quit?

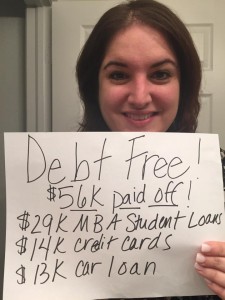

If you want to get out of debt, there’s one thing you need to know that’s more important than anything else. That’s the answer to this question: “What will keep you going when you want to quit?”. Because you WILL want to quit, especially if you’re working to pay off a lot of debt. So get yourself a strong why; something that will keep you going when times get tough and re-inspire you on a regular basis. – Jackie Beck of The Debt Myth

You Do Not Need a Lot of Money

You Do Not Need a Lot of Money

A misconception you should look to eliminate is that you need a lot of money to invest. We live in pretty incredible times and you can actually get started with whatever amount you feel comfortable with. Whether is $10 or $10,000; the point is to start! There are numerous online brokers out there you can choose from today, several of which have no account minimum. Not to mention up and coming start-ups specially tailored for beginners where you can even start by investing your spare change. – Mabel Nunez of Girls on the Money

It’s Not a Competition!

A piece of financial (and life!) advice for every single woman: Stop letting other women bring you down. Women have this competitive have-to-look-as-good-as-others mentality that cost us thousands of dollars a year. If financial excellence is something you strive for, stop spending money to look as good as others and start spending it on a diversified investment portfolio! – Vanessa Page of Vanessa’s Money

Stop Watching TV

Stop Watching TV

When you’re attempting to keep more money in your bank account, sometimes you have to close the magazines, stop watching TV (or at least quit watching commercials), and even limit media altogether for a while. The more you are exposed to the media, the more you are being sold to which increases your chances of impulse shopping and thinking you “need” something when you don’t. – Kesha Brown of Uncommon Chick

Invest in Yourself

Invest in Yourself

Women need to pay themselves first, which can be tough since we are socialized to take care of others before ourselves. In 2016, start paying yourself first by funding your retirement with as much as you can afford–even if that’s just 1%. Plan on increasing your retirement contribution each time you get a raise or receive a windfall. Eventually, you’ll be fully funding your retirement every year and taking great care of your future self. – Emily Guy Birken, Author of Choose Your Retirement: Find the Right Path to Your New Adventure

Not a “Man” Thing

Stop Using Debt

Defeat Your Debt

If you’re in credit card debt, you probably want to crawl under a blanket and pretend this whole terrible thing isn’t happening. I call this Head-in-Sand Syndrome. I understand this because I’ve been there. When I was in credit card debt, I spent a lot of time in denial. But here’s the thing. The longer it takes you to admit to and own your debt, the worse your situation gets. I know it’s tough, but stare down your debt and it will lose power over you. You’ll be amazed at how empowered you will feel when you take that step. Only then can you sit down and come up with a plan to defeat your debt. And defeat it, you will! –Beverly Harzog, Author of The Debt Escape Plan: How to Free Yourself From Credit Card Balances, Boost Your Credit Score, and Live Debt-Free

If you’re in credit card debt, you probably want to crawl under a blanket and pretend this whole terrible thing isn’t happening. I call this Head-in-Sand Syndrome. I understand this because I’ve been there. When I was in credit card debt, I spent a lot of time in denial. But here’s the thing. The longer it takes you to admit to and own your debt, the worse your situation gets. I know it’s tough, but stare down your debt and it will lose power over you. You’ll be amazed at how empowered you will feel when you take that step. Only then can you sit down and come up with a plan to defeat your debt. And defeat it, you will! –Beverly Harzog, Author of The Debt Escape Plan: How to Free Yourself From Credit Card Balances, Boost Your Credit Score, and Live Debt-Free

Know Your Numbers

What is Next…

Andrea is the Chief Chick of Smart Money Chicks. After filing BK twice (once because she panicked, second time because the pro messed the first time up), she realized that it all could have been avoided if she understood more about how her Finances worked and the options available. At that point, she wanted to help as many as she could never make the same mistakes again. Our Promise is that all the content you read on here is created or edited by Andrea

Love this! These are some great tips from some great women. 🙂